American households hoping that interest rates will soon fall will have to wait a little longer.

The Federal Reserve is expected to keep the key interest rate unchanged on Wednesday, at least until there are clearer signs that inflation is rising more slowly. But forecasters will be listening to Jerome H. Powell, the Fed chairman, for any indication of how long they expect to keep rates relatively high.

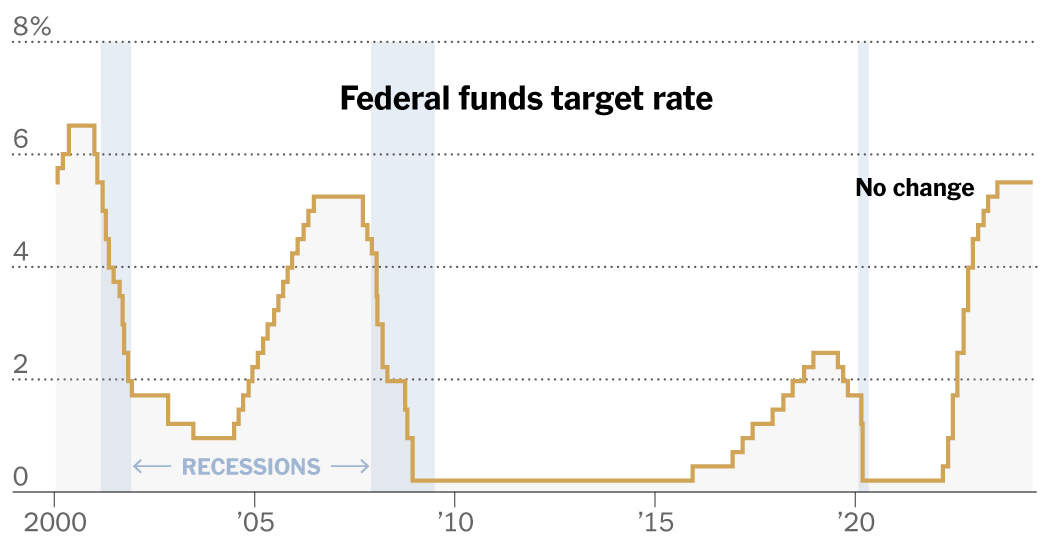

The central bank raised the key interest rate to 5.33 percent from near zero in a series of hikes between March 2022 and last summer, and they have remained unchanged since then. The goal was to reduce inflation, which has cooled significantly but is still higher than the Fed would like, suggesting interest rates may remain high for longer than economists expected.

For people with money stashed away in higher-yielding savings accounts, a continuation of high rates translates into more interest earnings. But for people saddled with high-cost credit card debt, or for aspiring homeowners who have been sidelined by higher interest rates, a lower-rate environment can’t come soon enough.

“Shopping around, whether you’re looking for an auto loan, a credit card, a personal loan or any other type of loan, can make a big difference,” said Matt Schulz, an analyst at LendingTree, an online loan marketplace. .

Here’s how various rates are affected by the Fed’s decisions — and where they stand.

Credit cards

Credit card rates are closely tied to central bank actions, meaning consumers with revolving debt have seen those rates rise quickly over the past two years. Increases usually occur within a billing cycle or two, but don’t expect them to drop that quickly even when rates eventually drop.

“The urgency to pay off high-cost credit card or other debt hasn’t diminished,” said Greg McBride, chief financial analyst at Bankrate. “Interest rates went up with the elevator, but they will take the stairs coming down.”

This means consumers should prioritize paying off the highest-cost debt and take advantage of zero-percent and low-rate balance transfer offers when they can.

The average rate for rated interest credit cards was 22.63 percent at the end of March, according to the Federal Reserve, compared with 20.92 percent a year ago and 16.17 percent at the end of March 2022, when the Fed began its rate hike streak. . .

Loans for cars

Car loan rates remain high, which has reduced affordability and reduced demand among potential car buyers. But automakers and dealers have started offering more discounts and other incentives, which has lured some buyers back into the market.

“In May, we saw some positive news on the sales front,” said Erin Keating, executive analyst for Cox Automotive. “Many of these sales gains were accompanied by higher incentives and lower prices, which is good news for consumers concerned about inflation.”

The average new car loan rate was 7.3 percent in May, according to Edmunds, up from 7.1 percent in 2023 and 5.1 percent in 2022. Used car rates were even higher: The average loan was 11.5 percent in May , rising from 11 percent in 2023 and 8.2 percent in 2022.

Car loans tend to track the yield on the five-year Treasury note, which is affected by the Fed’s key rate — but that’s not the only factor that determines how much you’ll pay. A borrower’s credit history, vehicle type, loan term and down payment are all factored into that rate calculation.

MORTGAGES

Mortgage rates have also remained high: The most popular loan crossed the 7 percent mark in mid-April and has largely held that position since then, making home ownership an even more expensive proposition.

The average 30-year mortgage rate was 6.99 percent as of June 6, according to Freddie Mac, compared with 6.71 percent in the same week last year.

It’s been a bumpy ride. Rates rose as high as 7.79 percent in late October before falling around a point lower and stabilizing — at least temporarily.

“Rates are only 7 percent, and we expect them to decline modestly through the remainder of 2024,” said Sam Khater, Freddie Mac’s chief economist. “If a potential buyer is looking to buy a home this year, waiting for lower rates may result in small savings, but shopping around for the best price remains extremely beneficial.”

30-year fixed-rate mortgage rates do not move with the Fed’s benchmark, but generally track the 10-year Treasury yield, which is affected by a number of factors, including inflation expectations, actions and how investors react.

Other home loans are more closely related to central bank decisions. Home equity lines of credit and adjustable-rate mortgages — which each have variable interest rates — generally go up within two billing cycles after a change in Fed rates. The average rate on a home equity loan was 8.6 percent as of June 6, according to Bankrate, while the average home equity line of credit was 9.18 percent.

Student loans

Borrowers who already have federal student loans are not affected by the Fed’s actions because such debt carries a fixed rate set by the government.

But rates on new federal student loans are poised to rise to their highest level in a decade: Borrowers with federal student loans disbursed after July 1 (but before July 1, 2025) will pay 6.53 percent, up from 5.5 percent for loans disbursed in the same period of the previous year.

Loan rates for graduate and professional students will increase to 8.08 percent. And rates on PLUS loans — financing available to parents of graduate students as well as graduate students — will rise to 9.08 percent.

Rates are estimated each July using a formula that is based on the 10-year Treasury bond auction in May.

Private student loan borrowers have already seen rate increases due to previous rate hikes: Both fixed-rate and variable-rate loans are tied to benchmarks that follow the federal funds rate, the Fed’s base rate.

Savings vehicles

Savers typically benefit when the federal funds rate is higher because many banks charge more in their savings accounts — especially if they want to attract more deposits. (Many banks make money from the difference between their cost of funds, such as deposits, and the interest rate they charge on loans.)

Online institutions tend to price their savings accounts much more competitively than their peers, though some have started lowering their rates because they had expected the Fed to cut rates at some point this year. Certificates of deposit, which tend to track similar-dated Treasury securities, have already seen their rates cut several times this year.

“The small gains and decline in online deposit rates are likely to continue this year until we get closer to the Fed’s next rate cut or rate hike,” said Ken Tumin, founder of DepositAccounts.com.

The average one-year CD at online banks was 4.96 percent as of June 3, down from a peak yield of 5.35 percent in January but down from 4.86 percent a year earlier, according to DepositAccounts.com. But you can still find one-year CDs yielding more than 5.25 percent.

Most online banks have kept their savings account rates relatively steady: The average return on an online savings account was 4.40 percent as of June 3, just down from a peak of 4.49 percent in January, according to DepositAccounts.com, and from 3.98. percent a year ago.

The returns on money market funds offered by brokerage firms are even more attractive because they have more closely tracked the federal funds rate. The return of the Crane 100 Money Fund Index, which tracks the largest money market funds, was 5.12 percent on June 11.